Unlocking Financial Freedom: Insights from JL Collins’ The Simple Path to Wealth

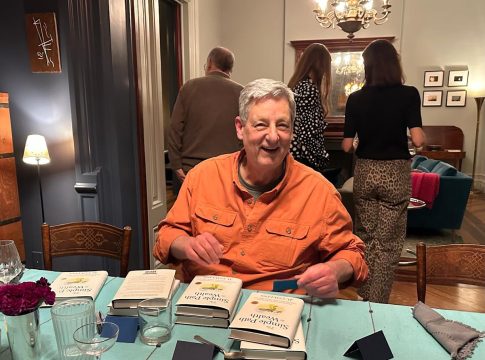

Author and blogger JL Collins has made waves in personal finance with his book, The Simple Path to Wealth: Your Road Map to Financial Independence and a Rich, Free Life, first published in 2016. The book’s philosophy has resonated with many readers, leading to over a million copies sold. Now, Collins is back with a second edition, co-authored with his daughter, Jess, reflecting updates without changing core principles.

Timeless Wisdom: The Core Philosophy Remains

When asked what’s new in the latest edition, Collins confidently states: “Nothing. Zero.” The foundation he established a decade ago still stands firm. He emphasizes the importance of adopting a financial strategy that can stand the test of time and changing regulations—not a fleeting trend.

Three Pillars of Financial Independence

Collins kicks off his guide with three essential principles:

- Avoid Debt: Living with debt, he argues, is akin to a ball and chain on your journey to wealth.

- Live Below Your Means: Keeping expenses lower than your income allows you to save and invest.

- Invest the Surplus: Direct your savings towards low-cost index funds, which he considers the simplest investment strategy for long-term wealth building.

What Does Financial Independence Look Like?

For Collins, financial independence means having enough investments to cover your living expenses comfortably—a guiding principle he reflects in the “25 times your annual expenses” rule. Essentially, if you need $40,000 annually to cover expenses, you should aim to build a portfolio of at least $1 million, based on the 4% rule. This guideline suggests you can withdraw 4% of your investment annually without depleting it.

The Bold Move: Save 50% of Your Income

Saving half of your income might sound daunting, yet Collins insists it’s achievable with the right lifestyle adjustments. He’s seen many succeed by prioritizing savings, which shortens the path to financial independence.

Weathering Market Turbulence

One of the most critical aspects of investing is resilience during market downturns. Collins advises investors to stay the course during fluctuations, as panic selling often leads to losses. Instead, view market dips as an opportunity to accumulate more shares at lower prices, strengthening your portfolio for the long haul.

Simplicity is Key: The Ideal Investment Strategy

Collins advocates investing in a total stock market index fund, such as Vanguard’s Total Stock Market Index Fund. This strategy provides exposure to virtually all publicly traded companies, reducing risk while enhancing returns. When transitioning into retirement, he also recommends adding a bond fund to your portfolio.

The Take on Alternative Investments

While many are drawn to trendy investments like cryptocurrencies or private equity, Collins cautions against straying from simplicity. He prefers proven methods of investment that focus on assets capable of generating cash flow, rather than speculating on untested ventures.

Bottom Line: Your Path to Wealth

Collins’ approach to personal finance champions a straightforward and sustainable path to wealth. By avoiding debt, living within your means, and investing wisely, you can achieve the financial independence you desire. As you navigate your own financial journey, keep these core principles in mind, and remember that the road to wealth is not just about money—it’s about gaining freedom and making choices that enrich your life.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.