Powell Faces Political Turbulence at the Fed: What It Means for Your Finances

A Challenging Time at the Fed

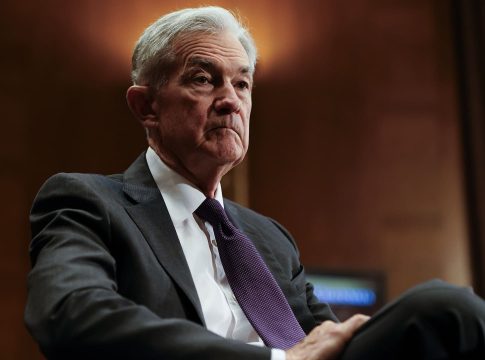

Federal Reserve Chairman Jerome Powell recently testified before the Senate Committee on Banking, Housing, and Urban Affairs, but he’s facing a new wave of challenges. With President Donald Trump hinting at a potential leadership change at the Fed next year, the markets are reacting—raising questions about the future direction of U.S. monetary policy.

Trump’s Criticism and Its Impact

During a NATO summit, Trump didn’t hold back in his criticism of Powell, describing him as “terrible” and even suggesting he has a “low IQ.” While this isn’t new—Trump has had a contentious relationship with Powell since he was appointed—it raises concerns about stability within the Federal Reserve. Such political turbulence often leads to market volatility, which can impact interest rates and your personal finances.

Market Reactions: What to Expect?

In response to Trump’s remarks, Wall Street’s anxiety is palpable. Investors are now more inclined to bet on interest rate cuts this year, with expectations shifting dramatically. Here’s a snapshot of the current market landscape:

- Rate Cuts Likely? Traders anticipate a 60% chance of three rate cuts by the end of the year, compared to previous expectations of just two.

- Falling Treasury Yields: Yields on shorter-term Treasury bonds have dropped significantly, meaning lower interest rates may be on the horizon.

- Dollar Dip: The U.S. dollar has weakened against foreign currencies, which could affect everything from travel expenses to the cost of imported goods.

Potential Successors and the Political Climate

As the political landscape shifts, Trump has hinted at having a shortlist of potential Fed leaders. Names like Treasury Secretary Scott Bessent and former Fed Governor Kevin Warsh are mentioned, but nothing is confirmed. The uncertainty isn’t just a political issue; it’s a financial one, affecting everyone from the average consumer to large investors.

What Does This Mean for You?

-

Stay Informed: Given the potential for new leadership at the Fed, it’s crucial to keep an eye on policy changes that could impact interest rates and your borrowing costs.

-

Review Your Budget: If rates drop, consider reassessing your loans. Refinancing a mortgage or consolidating high-interest debt could save you money in the long run.

- Understand Rate Effects: Interest rates affect everything from savings account returns to loan rates. Stay updated to make informed financial decisions.

Conclusion: Planning for Uncertainty

The interplay between politics and finance can feel daunting. However, by staying informed and proactive, you can navigate these changes effectively. As Powell continues to lead amid criticism, understanding how these dynamics influence monetary policy will be key for maintaining your financial health.

Always consider professional advice tailored to your personal financial situation, especially during uncertain times like these.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.