BlackRock’s Strategic Move: The Impact of Acquiring Preqin

In a significant shift for BlackRock, the world’s largest asset manager has made waves with its recent acquisition of Preqin, a data provider specializing in alternative assets. This $3.2 billion deal, which may seem modest compared to other large investments, could revolutionize how BlackRock engages with private markets.

A Game-Changer for Private Market Investments

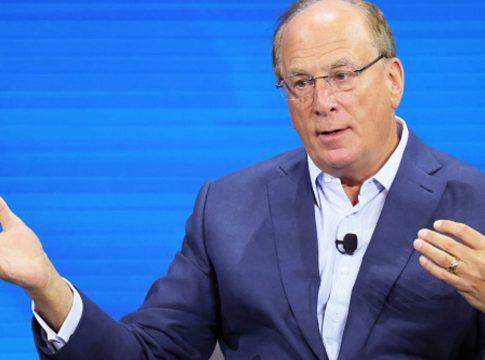

Larry Fink, BlackRock’s CEO, emphasized during a recent industry conference that acquiring Preqin could be a defining moment for the firm. By integrating Preqin’s extensive data resources into its existing platforms, such as Aladdin and eFront, BlackRock aims to bring unprecedented transparency to the often murky realm of private investments, which includes sectors like private equity and real estate.

Imagine trying to buy a house without knowing the market value or recent sales in the neighborhood; that’s akin to navigating private markets today. With Preqin’s data, investors can gain better insights, helping them make informed decisions.

Diversifying Revenue Streams

BlackRock CFO Martin Small noted that integrating Preqin’s capabilities would pave the way for new revenue avenues, reducing reliance on the volatility of stock and bond markets. This diversification is vital as the firm continues to manage trillions in assets. Currently, many of its earnings fluctuate with market conditions, making additional income sources essential for stability.

The acquisition is already making its mark, contributing roughly $20 million to BlackRock’s revenue in the first quarter of 2024, despite the transaction closing just weeks prior.

Future Potential for Retail Investors

While the focus has been on institutional clients, the potential for retail investors could soon be realized. Fink has discussed how private-market investments might be integrated into retirement accounts, offering average investors access to opportunities that have traditionally been reserved for the wealthy.

However, this move isn’t without its risks. Analysts at Moody’s have raised concerns about the challenges of increasing retail access to private markets, which could include heightened regulatory scrutiny and reputation risks for BlackRock.

Expanding Market Presence

The acquisition also positions BlackRock strategically in a rapidly growing sector. Private markets have gained traction among investors seeking alternatives to traditional assets. Competing with limited data providers, Preqin’s robust information set can help BlackRock solidify its market position.

Historically, acquisitions like Preqin have proven successful for BlackRock; for instance, the 2019 acquisition of eFront led to a doubling of its annual contract value. Similar success is anticipated with Preqin, which should foster deeper client relationships and spur sales growth across BlackRock’s offerings.

Looking Ahead

As the investment landscape evolves, Fink envisions a future where public and private markets become increasingly intertwined. While BlackRock’s path forward may come with complexities, its focus on innovation with acquisitions like Preqin promises to usher in a new era for private market investments.

In conclusion, BlackRock’s strategic acquisition of Preqin may redefine investment opportunities, increase transparency, and set a precedent for blending private market insights with traditional public investment strategies. Stay tuned—this could be just the beginning of a significant shift in how we invest.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.