Oracle’s AI Momentum: Financial Results Reflect a Cloud-Driven Transformation

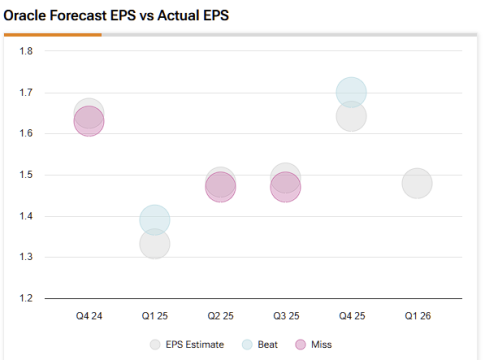

Oracle (ORCL) recently released its quarterly financial results, showcasing impressive growth fueled by advancements in cloud technology, especially in artificial intelligence (AI). With a year-over-year revenue increase of 11% to $15.9 billion and non-GAAP earnings per share of $1.70—exceeding expectations—Oracle appears to be firmly positioned as a leader in the cloud and AI sectors.

Cloud Services Lead the Charge

Oracle’s cloud divisions stood out in their latest performance. The combined revenue from its cloud offerings, which include Infrastructure as a Service (IaaS) and Software as a Service (SaaS), soared 27% year-over-year, reaching approximately $6.7 billion. The real standout, however, was Oracle Cloud Infrastructure (OCI), which jumped by an impressive 52% to $3 billion. This surge highlights Oracle’s strategic focus on accommodating AI workloads, a rapidly growing segment within cloud services.

Multi-Cloud Strategy Pays Off

A key element driving this cloud momentum is Oracle’s effective multi-cloud strategy. CEO Larry Ellison announced during the earnings call that their MultiCloud database services have experienced a staggering 115% growth quarter-over-quarter, demonstrating an ability to turn potential competitors—such as Amazon and Microsoft—into collaborators. As organizations increasingly seek hybrid and multi-cloud solutions, Oracle is carving out a significant competitive edge in a saturated market.

Record Backlog Signals Future Growth

Another promising indicator for Oracle’s future is its staggering backlog of contracts, known as Remaining Performance Obligations (RPO). This metric soared to an all-time high of $138 billion, a 41% increase from the previous year. Such a strong backlog suggests robust demand and provides substantial revenue visibility for shareholders. Notably, major contracts with tech giants like OpenAI and Nvidia have bolstered this position, aligning Oracle with the ongoing AI revolution.

Strategic Investments and Their Implications

Of course, scaling its cloud infrastructure comes at a cost. Oracle invested roughly $21.2 billion in capital expenditures during the last fiscal year, primarily for building GPU clusters and data centers. While this has slightly compressed profit margins, Oracle maintains a solid operating cash flow of $20.8 billion, ensuring the company remains financially robust and capable of funding further growth initiatives.

However, this aggressive growth strategy does carry risks. If enterprise IT spending declines or customers gravitate toward rivals like AWS or Azure, Oracle might face challenges. Also, significant upfront investments mean that misjudgments in demand could lead to underutilized resources.

Market Insights and Future Outlook

The consensus among analysts is a "Moderate Buy," reflecting both optimism and caution. The average price target for Oracle shares stands at $192.91, suggesting a minor downside potential, indicating that despite strong operational performance, the market may have already priced the stock at a premium.

In conclusion, Oracle’s latest quarterly results underscore a successful transformation driven by strategic investments in cloud services and AI capabilities. The company’s focus on multi-cloud architecture and significant contract backlog positions it for potential long-term growth. As Oracle continues to navigate this complex landscape, its recent success may very well mark the beginning of a new era in its operational model. The momentum is undeniable—and the AI landscape is certainly watching.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.