High-Interest Credit Card Debt: Why It’s Time to Take Action

Kevin O’Leary’s Pragmatic Warning

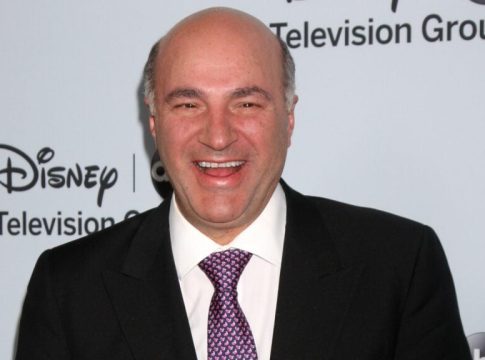

Kevin O’Leary, the charismatic investor from Shark Tank, doesn’t hold back when discussing personal finance. He’s notably vocal about the dangers of high-interest credit card debt, urging individuals to prioritize getting rid of it. With interest rates soaring to around 23%, O’Leary makes a compelling case: “Why pay that much on what you owe?”

The Unseen Threat of Debt

O’Leary refers to credit card debt as “the real silent killer in America.” Many people underestimate how quickly it can spiral out of control. For instance, the Federal Reserve Bank of New York reported that U.S. consumers collectively held a staggering $1.18 trillion in credit card debt in the first quarter of the year. This lingering debt often results from individuals spending beyond their means, filling the gap with credit.

Real Talk: Your Spending vs. Your Income

To tackle this issue, O’Leary recommends a straightforward approach:

- Track your finances. Take out a piece of paper (you don’t need fancy software) and jot down how much money you made and spent over the past 90 days.

- Compare the two. Are you spending more than you earn?

This simple exercise can provide clarity and help you identify unnecessary expenses.

The Power of Compounding Interest

O’Leary emphasizes the importance of paying off your credit card debt and starting to save, regardless of whether you’re in your 30s or 40s. "It’s never too late," he asserts. The magic of compounding interest means that even a decade of saving can yield significant financial rewards.

Advice from Other Financial Titans

Prominent billionaire Mark Cuban echoes O’Leary’s concerns. During a recent appearance on The Ramsey Show, he stated, "If you use your credit cards, you do not want to be rich." Cuban argues for eliminating credit card debt altogether, suggesting that paying it down can feel like earning a 15% to 20% return on your money.

Additionally, financial guru Dave Ramsey points out that a significant 75% of wealthy individuals prioritize staying debt-free. This is a simple but powerful mindset.

Spend Wisely, Live Freely

Ultimately, O’Leary underscores one key principle: buy only what you can truly afford. He illustrates this by contrasting a luxury Rolex, worth $150,000, with an affordable $300 Timex. Both serve a purpose but demonstrate how smart choices can be made without sacrificing quality of life.

Conclusion: Your Financial Future Starts Now

Getting out of credit card debt should be front and center in your financial goals. Remember, it’s not just about clearing your balance—it’s about building a secure financial foundation for the future. With practical strategies in place, you can regain control and pave the way for a debt-free life. The time to act is now!

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.