Health Insurance Under Threat: The Impact of the House Tax Bill

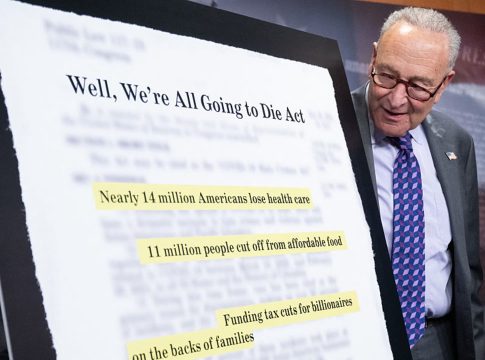

A major tax and spending bill recently passed by the House of Representatives could drastically reshape the landscape of health insurance in America. With cuts to Medicaid and the Affordable Care Act (ACA) in the mix, experts predict that millions of Americans could lose their health coverage if the bill remains unchanged as it heads to the Senate.

Millions at Risk of Losing Coverage

According to projections from the Congressional Budget Office (CBO), about 11 million Americans could find themselves without health insurance if this legislation is enacted. This includes 4 million people who would lose coverage due to expiring Obamacare subsidies that the bill does not extend.

The proposed changes introduce stricter barriers to access, higher costs, and outright benefit denials for certain populations, particularly legal immigrants. As Alice Burns from the Kaiser Family Foundation (KFF) highlights, this shift represents a significant rollback in health coverage, marking a potential "largest retraction" the U.S. has ever seen.

Medicaid Cuts and New Requirements

The legislation aims to cut over $800 billion from Medicaid over the next decade. A key provision includes implementing new work requirements for individuals aged 19 to 64 in states that expanded Medicaid. Under these requirements, recipients would need to demonstrate 80 hours of work or qualifying activities each month.

The CBO estimates that these stipulations could lead to 5.2 million adults losing their Medicaid coverage, with a net effect of 4.8 million more uninsured individuals. House Speaker Mike Johnson insists that these requirements are not too burdensome, arguing that they would not force anyone off their coverage unless they choose to stop participating (a debatable assertion).

Increased Financial Strain for Families

In addition to Medicaid cuts, the bill has serious implications for those relying on the ACA. Currently, more than 24 million people utilize ACA marketplaces for their health insurance. The expiration of enhanced premium tax credits, which helped lower costs for many families, could leave 4.2 million individuals uninsured by 2034, according to the CBO.

Without these subsidies, the average family of four making $65,000 may see their annual health insurance costs soar by approximately $2,400. For many, this could make securing coverage simply unaffordable.

Administrative Hurdles and Eligibility Complexities

The proposed legislation also introduces various administrative hurdles that could complicate the enrollment process. Changes include:

- Shortening the annual open enrollment period

- Ending automatic re-enrollment for existing policyholders

- Delaying eligibility rules that simplify Medicaid enrollment

These adjustments—while often seen as purely bureaucratic—could result in significant coverage losses. According to health policy experts, increased red tape can deter individuals from seeking necessary insurance, akin to making a road bumpy for a delivery truck.

The Upshot: Potential Changes Ahead

As the bill moves to the Senate, the health care cuts are under scrutiny. Some Republican senators are already expressing concerns about the Medicaid cuts, which could stall the process.

Before any final decisions, it’s vital for individuals to closely monitor this situation. Staying informed and proactive about health coverage options can be essential, particularly as changes in policy can have far-reaching effects on personal finances.

In these uncertain times, understanding how shifts in health care policy could affect your wallet is more crucial than ever. Consider local resources, financial advisors, or healthcare navigators who can guide you through potential changes to keep you informed and insured.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.