SSI and SSDI Payments: Who Will Receive Them Before July 4?

If you rely on Social Security payments, you’re likely eager to know when those funds will hit your account. With July 4 approaching, let’s break down who will receive Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI) payments before the holiday. Understanding this schedule can help you better manage your budget and financial responsibilities.

Payment Schedule Explained

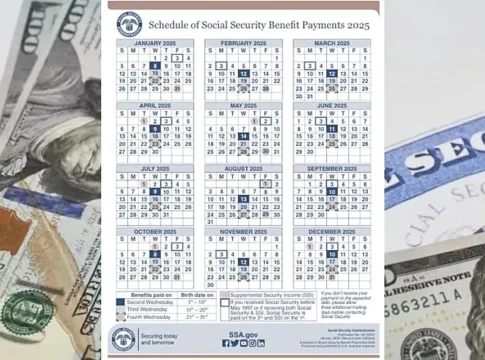

The Social Security Administration (SSA) issues payments to SSI and SSDI beneficiaries on a specific calendar, and these payments can affect your ability to plan for upcoming expenses. For the month of July, the SSA has a set timeline for distributing these payments:

-

SSI Payments: These payments are typically made on the first of the month. If the first is a holiday or weekend, as is the case this year, you can expect payments to be issued on the last business day prior to the holiday. For July, expected payments will hit on June 30.

- SSDI Payments: These are typically paid based on the day you were born. If your birthday is on the 1st through 10th, payments are made on the second Wednesday of each month. If it’s between the 11th and 20th, expect your payment on the third Wednesday, and for those born from the 21st to the 31st, payments come on the fourth Wednesday.

Who Gets What Before July 4?

In the lead-up to July 4, all SSI recipients can expect their payments on June 30. Meanwhile, SSDI beneficiaries might receive theirs around the second, third, or fourth Wednesday in July, depending on their specific birth dates. Knowing your payment date means you can plan your spending with confidence.

Practical Budgeting Tips

To make the most of your upcoming Social Security payments, consider these practical tips:

-

Plan for Essentials: Use the payments to cover crucial expenses like rent, utilities, and food first. This will help you avoid shortages later in the month.

-

Set Aside for Emergencies: If you can, try to save a portion of your payment as an emergency fund. Even small amounts can add up over time.

- Track Your Spending: Use budgeting apps or simple spreadsheets to keep an eye on your cash flow. This can help you avoid overspending and ensure your payments last through the month.

Final Thoughts

Understanding your Social Security payment schedule isn’t just about knowing when to expect funds; it’s about planning your financial future. By staying informed, you can make smarter decisions that help you navigate your finances more effectively. Whether it’s budgeting, saving, or managing your monthly expenses, being proactive puts you in control.

As July 4 approaches, take time to review your financial needs with your upcoming payments in mind. With the right strategy, you can celebrate the holiday without the stress of financial worry!

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.