Jim Cramer’s Financial Wisdom: Navigating Uncertainty

Celebrating Two Decades of “Mad Money”

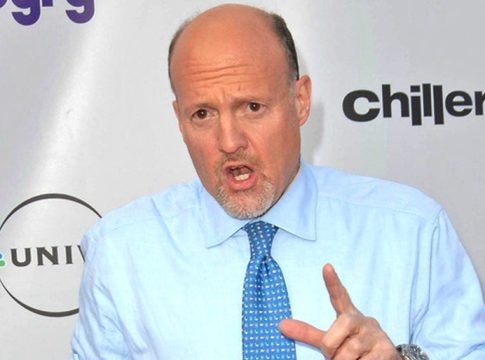

Jim Cramer, renowned host of CNBC’s “Mad Money,” is marking 20 years of financial advice on television. In a recent chat with NBC’s “Today,” Cramer reflected on how his show has connected with everyday investors. He noted that during the show’s beginnings, the economy faced significant challenges, yet those who stayed invested thrived. As many Americans now confront economic uncertainty due to tariffs and inflation, Cramer has some straightforward advice.

Stay the Course with Your Investments

Cramer firmly believes that sticking to your investment plan is crucial, especially in turbulent times. “Stay the course,” he urges, suggesting that even small, consistent contributions can make a difference. He recommends investing an extra $50 a month, which can accumulate over time and provide more financial security.

Focus on the S&P

When it comes to investment strategies, Cramer’s top pick is an S&P 500 fund. This type of fund includes a diverse range of large U.S. companies, offering a solid foundation for long-term growth. Cramer emphasizes the importance of differentiating between the market’s performance and political events, stating, “Never, ever lose faith in the country. Remember that the market and Washington’s happenings are not one and the same.”

Inflation Woes Ahead

Despite his optimistic outlook on the labor market, Cramer does foresee difficult times due to rising inflation. Speaking about the potential impacts of tariffs, he explained that while inflation may strain household budgets, it will likely not last forever. That said, Cramer warns that the upcoming months might present “bad stuff” for many Americans, making it challenging for them to manage their finances.

Economic Outlook: Recession Not on the Horizon

When questioned about an impending recession, Cramer confidently dismissed the idea, highlighting expectations for strong job growth. However, he cautions that consumers will need to brace themselves for rising prices—an adjustment to costs that may feel unprecedented.

Practical Tip: Talk to a Financial Advisor

In light of changing economic conditions, now might be a good time to consult a financial advisor. They can help tailor your savings and investment strategies to align with your personal goals, cutting down on taxes and maximizing your retirement savings.

In these uncertain times, Cramer’s insights provide guidance for navigating the financial landscape. By staying informed and proactive, you can work towards building a more secure financial future.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.