Rethinking Personal Finance Education: The Gambling Factor

When you think of personal finance education, traditional topics like budgeting, investments, and taxes likely come to mind. However, as more states implement personal finance requirements, they’re beginning to tailor these lessons to reflect local economies and cultural realities. A prime example of this is Oklahoma, where understanding the gambling landscape is integral to financial literacy.

The Gambling Landscape in Oklahoma

Oklahoma boasts over 140 casinos, ranking just behind Nevada. These establishments, primarily owned by Native American tribes, play a significant role in the state’s economy and culture. For many Oklahomans, visiting a casino is a rite of passage at 18, making it essential for students to grasp both the economic implications and the risks associated with gambling.

During a visit to the Grand Casino in Shawnee, I quickly learned that casinos are designed to profit from their patrons. Chad Mathews, the casino’s marketing director, emphasizes responsible spending: “My son is 20, and I always tell him to avoid casinos because he just doesn’t have the financial cushion for it,” Mathews points out. His advice highlights a fundamental tenet of personal finance: only gamble with what you can afford to lose.

Educating the Next Generation

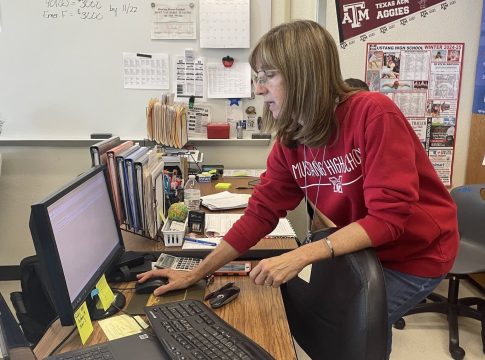

Providing insightful lessons about gambling is critical, especially in classrooms like those taught by Carrie Hixon at Mustang High School near Oklahoma City. Hixon engages students with practical discussions—starting with a simple question: “How much do Americans spend on lottery tickets each year?” A powerful statistic reflects the reality: Americans wager over $113 billion annually, with many spending far more than they ever win.

To illustrate the odds of winning, Hixon uses coins in her classroom. When asked about the likelihood of flipping heads, some students mistakenly believe it increases due to previous outcomes. Hixon clarifies: “The odds reset with each flip—it’s always a 50-50 chance.” This hands-on approach helps students understand the randomness of gambling and gambling-related games.

Understanding the Risks

An important aspect of Hixon’s lessons is discussing gambling addiction, which is an inescapable reality for many in Oklahoma. According to the Oklahoma Association on Problem Gambling and Gaming, about 5% of residents exhibit signs of a gambling disorder—twice the rate from just a decade ago.

Students like Brayden Pierce resonate with this topic; he acknowledges his struggles with gambling, stemming from early experiences in video games where loot boxes are a gamble themselves. Reflecting on this, he admits, “I often believe I win a lot—it’s a captivating aspect.” Hixon aims to instill a sense of responsibility, encouraging students to approach gambling with caution: “The odds are not in your favor.”

A Growing Concern

As online gambling expands, the demand for comprehensive educational resources grows. Other states are reaching out to Oklahoma’s Council on Economic Education, eager to learn how they can prepare students for the financial realities of gambling.

Practical Takeaways

- Know Your Limits: Only gamble with money you can afford to lose.

- Educate Yourself: Understand the odds and risks involved in any gambling activity.

- Recognize Signs of Addiction: Be aware of gambling disorders and seek help if needed.

Incorporating local factors like gambling into personal finance education not only prepares students for their immediate financial realities but also equips them with savvy decision-making skills that will serve them throughout life.

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.