Your Guide to Smart Personal Finance: Insights for Everyday Success

Managing your personal finances can sometimes feel overwhelming, but with the right tools and mindset, anyone can master their money. Here, we break down essential financial topics into manageable chunks, helping you make informed decisions and thrive financially.

Budgeting Basics

Creating a budget is the foundation of any solid financial plan. Think of it as a roadmap for your money. To start:

- Track Your Expenses: Keep an eye on where your money goes—this can include everything from rent and groceries to entertainment and monthly subscriptions.

- Set Clear Goals: Determine what you want to accomplish financially. Whether it’s paying off debt, saving for a vacation, or building an emergency fund, clear goals will guide your spending decisions.

- Review Regularly: Your budgeting needs can change. Make it a habit to review your budget monthly.

Quick Tip: Consider using budgeting apps like Mint or YNAB (You Need a Budget) to simplify the process.

Understanding Credit

Credit is a powerful financial tool that can work for or against you. Here’s what to keep in mind:

- Check Your Credit Score: Regularly monitoring your score can help you understand where you stand and what lenders see when you apply for a loan.

- Build Credit Wisely: Use credit cards for purchases you can afford to pay off each month. This will help you build a positive credit history, and can improve your score over time.

Did You Know?: A higher credit score can lead to lower interest rates on loans, saving you hundreds or even thousands over time!

Smart Investing

Investing might seem daunting, but it’s crucial for building wealth over the long term. Here’s how to get started:

- Start Early: The sooner you begin investing, the more potential you have for growth through compound interest.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes—stocks, bonds, and real estate—to minimize risk.

- Educate Yourself: Take time to learn about different investment vehicles and strategies. Online resources and financial courses can be invaluable.

Practical Example: If you invest $100 a month in a low-cost index fund with an average annual return of 7%, you could accumulate over $34,000 in 30 years!

Saving for the Future

Saving doesn’t just help you handle emergencies; it prepares you for future goals. Here’s how to boost your savings:

- Automate It: Set up automatic transfers from your checking to your savings account. Treat savings like a monthly bill.

- Create an Emergency Fund: Aim for three to six months’ worth of expenses in a separate, easily accessible account. This cushion can help you avoid going into debt during unexpected situations.

Note: High-yield savings accounts offer better interest rates than traditional accounts, maximizing your savings growth.

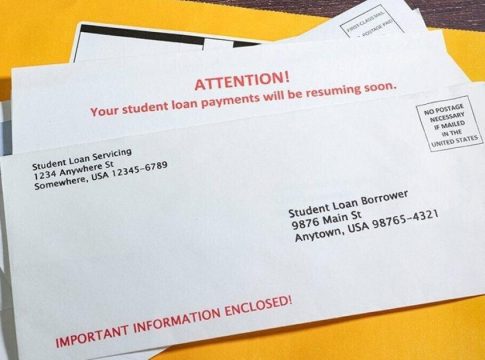

Conquering Debt

Debt can be a significant hurdle, but it’s not insurmountable. Here’s how to tackle it effectively:

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first, as they cost you the most over time.

- Explore Debt Snowball vs. Avalanche Methods: The snowball method focuses on paying off smaller debts first for quick wins, while the avalanche method targets high-interest debts to save on interest overall.

Final Thought: No matter where you’re starting from, taking small, consistent steps can lead to significant financial improvements over time. Your journey towards financial literacy and security is underway—embrace it with confidence!

Writes about personal finance, side hustles, gadgets, and tech innovation.

Bio: Priya specializes in making complex financial and tech topics easy to digest, with experience in fintech and consumer reviews.